Equity in forex/stock refers to the ownership interest in a company or the value of an investment. In simple terms, it represents the residual value of an entity after subtracting liabilities from assets, which makes it an indicator of financial stability and risk tolerance. Shareholders are entitled to a portion of the company’s profits and have voting rights in important decision-making processes. The value of equity is influenced by various factors such as the company’s financial performance, market conditions, investor sentiment, and industry trends.

In forex trading, equity is affected by the performance of the trader’s positions. When a trader opens a position, their equity is initially equal to their account balance. As the market moves, profits or losses are realized, thereby impacting the equity. If the trader’s positions are profitable, their equity will increase. Conversely, if the positions incur losses, the equity will decrease. A high equity balance indicates profitability and success, while a low equity balance may suggest losses or risk exposure.

Maintaining a healthy equity balance is crucial for traders and investors alike as it allows them to endure market fluctuations and potential losses without wiping out their entire investment. In forex and stock markets, having sufficient equity also enables traders to take advantage of opportunities and withstand potential drawdowns. In this regard, equity provides a buffer against adverse market conditions and allows investors to stay in the game for the long term.

[Video]: What is Equity?

How is Equity Calculated?

Equity calculation in forex/stock involves several factors.

The first step is to determine the account balance, which is the total amount of funds in a trader’s account and also includes the initial deposit and any additional deposits or withdrawals made.

The second step includes the unrealized profits or losses in the open positions. Unrealized profits refer to the potential gains if the trader were to close their positions at the current market price. Conversely, unrealized losses represent the potential losses if the positions were closed at the current market price.

Finally, the fees or commissions associated with the trades should be considered. This category can include spreads, swap fees, or any other transaction costs incurred during trading.

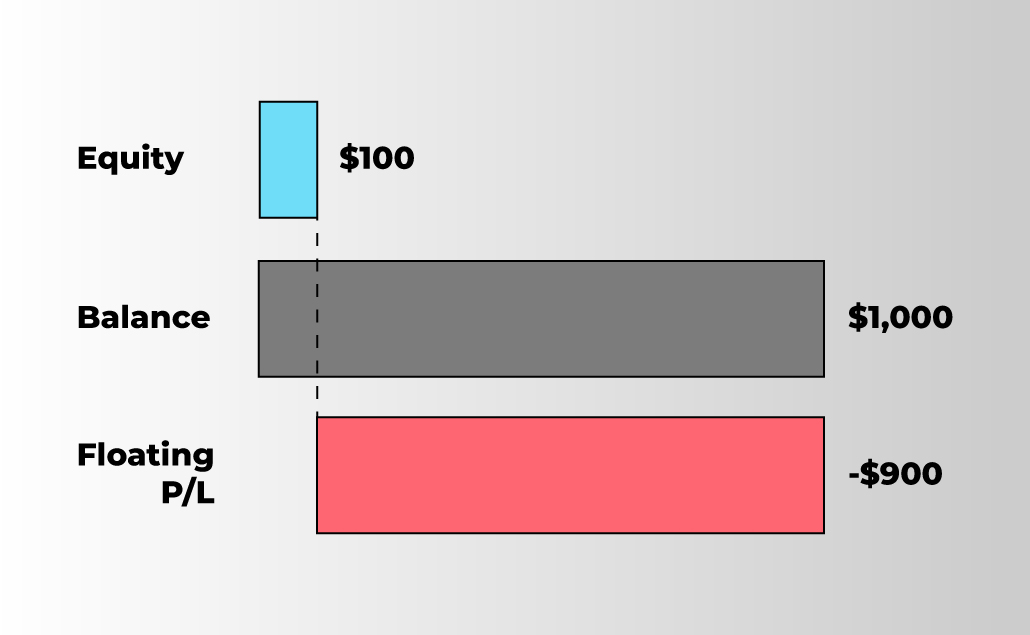

By subtracting the total losses and fees from the account balance, you can determine your equity. The formula for equity calculation in forex/stock is as follows:

Equity = Account Balance + Unrealized Profits/Losses – Fees/Commissions

Related Topics | Keep learning more with Eurotrader

Check out our video resources below for more information on trading different markets and much more on the basics of trading!

What are the Types of Equity?

There are several types of equity:

- Common equity: This represents ownership in a company through common shares. Common shareholders have voting rights and can participate in the company’s profits and growth.

- Preferred equity: Preferred shareholders have a higher claim on a company’s assets and earnings compared to common shareholders. They are usually given priority in receiving dividends and assets in the event of liquidation.

- Treasury stock: This refers to the shares of a company’s stock that it has repurchased from the market. It is held by the company itself and is not available for trading.

- Retained earnings: Retained earnings are the accumulated profits of a company that have not been distributed to shareholders as dividends. They are reinvested back into the company for growth and expansion.

- Employee stock options: These are equity-based incentives given to employees, allowing them to purchase company stock at a predetermined price.

- Convertible equity: This type of equity can be converted into another form of equity, such as common stock or preferred shares, at a later date.

Each type of equity represents a different form of ownership or claim on a company’s assets and earnings. Understanding these types of equity is important for investors and traders to make informed decisions about their investments and assess their potential returns.

How to Invest in Equities?

- Direct Stock Purchases: Buying shares of individual companies through a brokerage account.

- Stock Mutual Funds: Investing in a diversified portfolio of stocks managed by professionals.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges like individual stocks.

- Index Funds: Investing in a portfolio that tracks a specific stock market index.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvesting dividends to buy more shares.

- Options Trading: Buying or selling options contracts based on the price movement of underlying stocks.

- Margin Trading: Borrowing money from a brokerage to buy stocks, amplifying

Disclaimer

Eurotrader doesn’t represent that the material provided here is accurate, current, or complete, and therefore shouldn’t be relied upon as such. The information provided here, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product, or instrument; or to participate in any particular trading strategy. We advise any readers of this content to seek their advice.